Contactless Cards vs Digital Wallet Cards

Contactless Cards

Pros:

Convenience: Contactless cards offer a convenient way to make payments without the need to insert or swipe the card. Users can simply tap their card on the payment terminal to complete transactions quickly.

Speed: Contactless transactions are faster than traditional card transactions, reducing wait times and improving overall customer experience.

Security: Contactless cards use advanced encryption technology, making them secure and minimising the risk of card fraud. The card remains in the user's possession during the transaction, reducing the chances of card skimming.

Wide Acceptance: Contactless payment technology has become widely adopted, making it compatible with numerous payment terminals and merchants globally.

Contactless Limits: Many countries impose limits on contactless transactions, adding an extra layer of security. Users may need to enter their PIN for higher-value transactions, reducing the risk of unauthorised use.

Cons:

Limited Compatibility: While contactless technology is prevalent, there may still be instances where certain payment terminals do not support contactless payments, requiring the cardholder to use the traditional chip or swipe method.

Potential for Accidental Payments: In crowded places or when cards are stored together, there is a possibility of unintentional payments if the card comes in contact with a payment terminal without the user's knowledge.

Battery Drain: Some contactless cards have a small battery to power the contactless functionality. If the battery runs out, the contactless feature may become temporarily unavailable until the battery is replaced.

Digital Wallet Cards (e.g., Apple Pay, Google Pay):

Pros:

Convenience: Digital wallet cards allow users to store multiple payment cards digitally in one place, eliminating the need to carry physical cards.

Enhanced Security: Digital wallet transactions use tokenisation and encryption to protect sensitive card information. The card details are not shared directly with the merchant, reducing the risk of data breaches and fraud.

Accessibility: Users can make payments using their smartphones or wearable devices, providing easy access to payment options wherever they go.

Loyalty and Rewards Integration: Digital wallet cards often allow users to store loyalty cards and redeem rewards seamlessly during transactions, enhancing the overall customer experience.

Contactless and Online Payments: Digital wallet cards can be used for both contactless payments in physical stores and online transactions, providing versatility in payment options.

Cons:

Device Dependency: Digital wallet cards require compatible smartphones or wearable devices to make payments. Not all devices support digital wallets, limiting accessibility for some users.

Merchant Acceptance: Although digital wallet acceptance is increasing, there may still be instances where certain merchants or regions do not support digital wallet payments.

Network Connectivity: Users need an internet connection to access their digital wallet and complete transactions. Limited or no network connectivity may hinder the ability to make payments.

Adoption Challenges: Some users may be hesitant to adopt digital wallet technology due to concerns about security, unfamiliarity, or reliance on physical cards.

Ultimately, the choice between contactless cards and digital wallet cards depends on individual preferences, convenience, and the level of acceptance in the user's environment. Both options offer enhanced payment experiences and improved security compared to traditional payment methods.

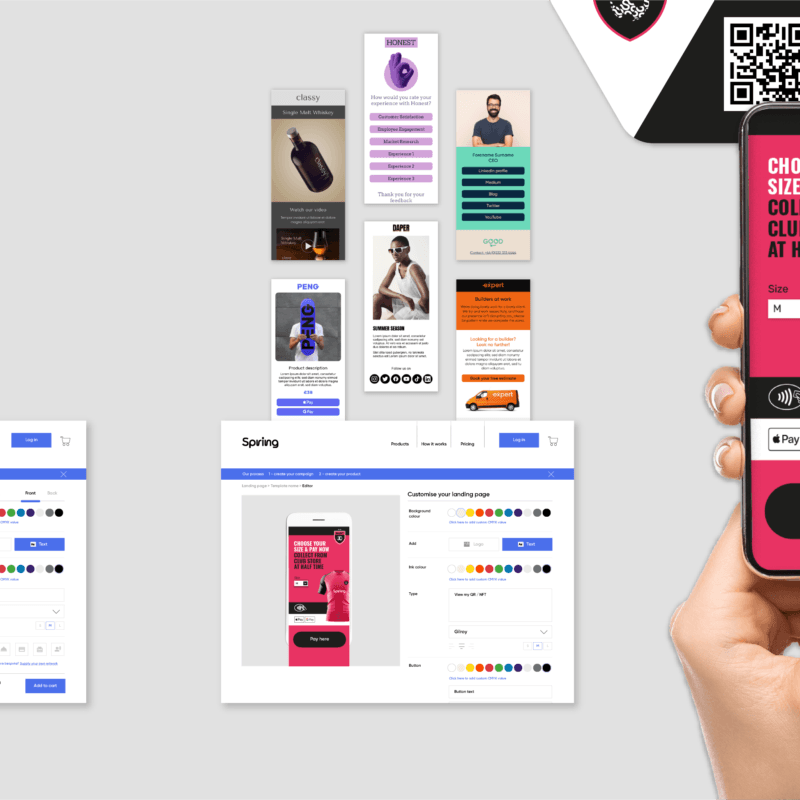

Spring delivers both contactless cards and digital wallet cards, giving consumers choice and your enterprise bigger opportunities.

Ready to enhance your customer experience?

Customise NFC and QR code products for identification, access control and more.